In the gig economy, understanding title loan tax deductibility is crucial for workers managing irregular income. Securing a car or boat title loan can offer significant savings by potentially deducing interest payments and fees during tax season. To qualify, gig workers must demonstrate primary business use of the vehicle and keep detailed records of related expenses. Consulting with a financial advisor or tax professional is essential to navigate these complexities and maximize tax advantages, including exploring alternative financing methods.

In the dynamic landscape of the gig economy, understanding tax benefits can be a game-changer. One often overlooked advantage is title loan tax deductibility, which offers a unique opportunity for workers to optimize their financial strategies. This article delves into the intricacies of title loan tax deductibility specifically tailored for gig economy workers. By exploring eligibility criteria and practical maximization strategies, you’ll discover how to navigate this powerful tool, ultimately enhancing your financial well-being.

- Understanding Title Loan Tax Deductibility for Gig Workers

- Qualifying for Tax Benefits: What You Need to Know

- Maximizing Deductions: Strategies for Gig Economy Workers

Understanding Title Loan Tax Deductibility for Gig Workers

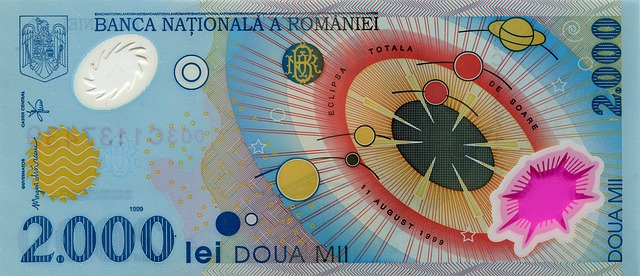

In the gig economy, where income can be irregular and unpredictable, understanding tax benefits is crucial for workers to optimize their financial situation. One often overlooked advantage is title loan tax deductibility. For those reliant on their vehicles for work—think rideshare drivers or independent contractors—this can be a significant avenue for potential savings. If you take out a car title loan, which uses your vehicle’s title as collateral, certain aspects of the borrowing process may be tax-deductible. This includes interest payments and other associated fees.

The title loan process involves securing a loan by pledging your vehicle’s title, allowing you to keep your vehicle while accessing cash. While the specifics can vary based on jurisdiction and lender, if the loan is primarily for business purposes, related expenses could be tax-deductible. It’s important to consult with a financial advisor or tax professional to navigate these complexities. Keep in mind that proper record-keeping is essential when it comes to title loan tax deductibility claims to ensure you can justify any deductions during tax season.

Qualifying for Tax Benefits: What You Need to Know

In the gig economy, where income can be irregular and unpredictable, understanding tax benefits is crucial for managing your finances effectively. One such advantage that gig workers may qualify for is title loan tax deductibility. To take advantage of this, it’s essential to meet certain criteria. Firstly, you’ll need to demonstrate that your vehicle, secured through a title loan, is primarily used for business purposes. This means proving that the car facilitates your work-related activities, such as commuting to jobs or transporting equipment and supplies.

Additionally, keeping detailed records of expenses related to your vehicle can significantly enhance your tax benefits. Documenting maintenance costs, fuel expenses, and even insurance fees associated with the vehicle is vital. Since many title loan providers offer direct deposit options, it’s advantageous to use these services as records of transactions can be easily maintained. Furthermore, undergoing a thorough vehicle inspection before securing a title loan ensures that you’re aware of any existing issues, providing clear documentation for tax purposes.

Maximizing Deductions: Strategies for Gig Economy Workers

Maximizing deductions can be a game-changer for gig economy workers looking to navigate their taxes efficiently. One often overlooked strategy involves exploring the potential tax benefits of alternative financing methods, such as boat title loans or loan refinancing. These financial solutions can offer unique opportunities for tax deductibility, allowing workers to offset business expenses and reduce their overall tax burden.

By utilizing these options, gig economy workers can potentially write off significant costs associated with their work. For instance, a boat title loan specifically designed for self-employed individuals might allow them to deduct interest payments on their taxes. Similarly, refinancing existing loans to secure better terms could result in lower interest rates and more substantial deductions over time. It’s essential to consult with a tax professional who can guide workers through these options, ensuring they fully understand the eligibility criteria and maximize their tax advantages.

Gig economy workers can leverage title loan tax deductibility to optimize their financial strategies. By understanding the eligibility criteria and implementing maximizing deduction strategies, these independent contractors can legally reduce their taxable income and potentially save significant money. Embracing these tips empowers gig workers to navigate the complexities of taxes with confidence, ensuring they make the most of every dollar earned.